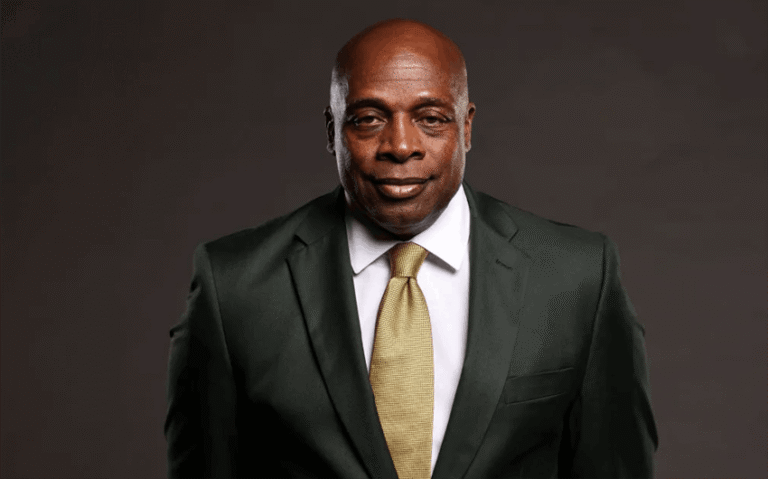

David Rubenstein Biography: Carlyle Co-Founder, Philanthropist, Orioles Owner, and Interviewer

David Rubenstein is one of those rare figures who lives at the intersection of money, power, and civic life—yet he’s widely recognized for how publicly he talks about it. You might know him as the co-founder of The Carlyle Group, the principal owner of the Baltimore Orioles, or the guy who sits across from presidents and CEOs asking unusually thoughtful questions. Here’s who David Rubenstein is, how he built his influence, and why his name shows up far beyond Wall Street.

Who Is David Rubenstein?

David Rubenstein is an American financier, lawyer, and philanthropist best known for co-founding The Carlyle Group, a private investment firm that became one of the biggest names in private equity. But “private equity founder” is only the beginning of his public identity. Over time, Rubenstein became something like a translator between elite finance and the wider public: he talks openly about how power works, how big institutions make decisions, and why philanthropy matters in the modern U.S.

He’s also one of the more visible billionaires in America—not because he acts like a celebrity, but because he consistently chooses public roles that keep him in view. He doesn’t just write checks quietly. He gives landmark gifts to major cultural institutions, buys and restores historical documents, and sits onstage conducting long interviews with the kinds of people who normally avoid unscripted conversations.

Early Life: A Baltimore Story That Still Shapes His Image

Rubenstein was born and raised in Baltimore, Maryland, and he returns to that origin story constantly—not as a sentimental anecdote, but as a personal compass. His background is frequently described as modest, and his career arc is one of the classic American “upward mobility” narratives: public education, elite schooling, then a path into law, government, and finance.

That Baltimore identity matters because it’s not just where he’s from—it’s how he frames what success should do. In interviews, he often emphasizes gratitude, obligation, and the idea that wealth should carry responsibility. You can disagree with parts of private equity as a model and still recognize that Rubenstein has spent years trying to position himself as a civic-minded steward rather than a purely profit-driven mogul.

Education and Law: How He Learned to Operate in Powerful Rooms

Before finance, Rubenstein trained in law. That’s a key piece of how he thinks and communicates: careful language, structured arguments, comfort with institutions, and a strong sense of how rules and incentives shape behavior. Law also helped him build credibility early, especially in Washington, where legal training often functions like a passport into policy work.

Even if you never plan to work in law, the lesson from Rubenstein’s path is pretty clear: if you want long-term influence, you learn the system from the inside. He didn’t jump straight into Wall Street mythology. He moved through government and institutional settings first, which gave him a deep understanding of how decisions get made when politics, regulation, and money collide.

Washington Years: Why His Government Experience Still Matters

Rubenstein spent time working in Washington, including roles connected to government policy. This period is often overlooked because it’s less flashy than private equity, but it’s crucial to understanding his later success. Private equity at scale isn’t only about buying companies—it’s about navigating macroeconomics, regulation, global relationships, and institutional trust.

Government experience also shaped his network. Rubenstein is known for relationships across political and business worlds, and that doesn’t happen by accident. Washington teaches you how to speak the language of policy, how to read shifting political winds, and how to stay relevant across administrations. Later, when Carlyle grew, that institutional fluency became a competitive advantage.

Founding The Carlyle Group: The Move That Defined His Career

In 1987, Rubenstein co-founded The Carlyle Group. At a simple level, Carlyle is an investment firm that raises capital from institutions and investors, then buys and improves companies across industries. But what made Carlyle a defining force is how it helped professionalize the idea of private capital operating at global scale—building portfolios, managing assets, and creating returns outside the traditional public stock market.

Rubenstein’s role as a founder matters because founders don’t just “work at” a firm; they set the tone. Carlyle’s reputation over time included a strong emphasis on relationships, institutional credibility, and a kind of establishment polish that distinguished it from the more aggressively secretive stereotypes of private equity. That doesn’t mean Carlyle avoided controversy—private equity as a whole is frequently debated—but it does mean Rubenstein helped craft a version of the industry that looked legitimate to powerful institutions.

If you’re trying to understand why his name carries weight, this is the core: he didn’t just participate in finance; he helped build a major platform that shaped modern investing.

How Rubenstein Thinks About Leadership

One of the most interesting parts of Rubenstein’s public persona is that he constantly studies leaders—then shares what he learns. When he interviews CEOs, presidents, generals, and founders, he’s not just collecting stories. He’s building a philosophy of leadership out loud.

He tends to return to a few themes:

Preparation beats charisma. He highlights how many elite performers are obsessive about process.

Relationships are an asset. He treats trust like a form of capital that compounds over decades.

Reputation is fragile. He often frames credibility as something you build slowly and lose quickly.

That’s part of why he’s become an unusually popular “finance person” for general audiences. He doesn’t only talk about deals; he talks about decisions and character.

The Interviewer Role: Why “The David Rubenstein Show” Matters

Rubenstein expanded his influence through media in a way most financiers never attempt. As a long-form interviewer, he’s built a public identity around curiosity: asking powerful people about their failures, their habits, and the moments that shaped them.

This matters because it’s a different kind of power. In finance, influence often comes from controlling capital. In media, influence comes from shaping narratives. Rubenstein does both. He can sit in a room where capital moves, then later sit in a studio and shape how the public understands leadership, success, and national identity.

And here’s the underrated part: he’s not trying to “win” interviews. His style is less confrontational and more revealing—like someone trying to understand how the world actually works. That’s why high-level guests show up and talk.

Philanthropy: The “Patriotic Giving” Brand He Built

Rubenstein is widely known for high-profile philanthropy, especially gifts tied to American history and cultural institutions. He’s donated to museums, libraries, and public landmarks, and he’s been associated with preservation efforts that keep historical artifacts accessible to the public.

His philanthropic identity is not random. It’s strategic in a way that still feels personal. Instead of only funding abstract causes, he often supports visible institutions that shape collective memory: places families visit, students study, tourists photograph, and communities rally around. It’s philanthropy that reinforces national identity.

Whether you see that as inspiring or image-conscious depends on your perspective, but either way it’s consistent. Rubenstein has built a legacy narrative that says: wealth should contribute to the cultural and civic infrastructure of a country.

Baltimore Orioles Ownership: Why This Purchase Was Symbolic

When Rubenstein became the principal owner of the Baltimore Orioles, it wasn’t just a sports business headline. It read like a full-circle moment: a Baltimore kid who became a global finance leader returning to own a cultural institution in his hometown.

Sports franchises are not just companies. They’re emotional assets—carriers of identity, loyalty, and community history. That’s why this ownership move amplified Rubenstein’s visibility beyond finance audiences. Even people who don’t follow private equity understand what it means to own a team.

For Baltimore, it also signaled something broader: local pride mixed with hope for stability. When a team changes hands, fans don’t only want wins. They want a sense that ownership cares, invests, and understands the civic role the franchise plays. Rubenstein’s public statements around Baltimore often lean into that—framing the Orioles as part of the city’s spirit, not just a revenue model.

Why People Find Him Fascinating (Even If They Don’t Like Private Equity)

Rubenstein sparks interest for a simple reason: he’s a capitalist who talks like a civics teacher. He’s comfortable in elite financial systems, but he repeatedly emphasizes history, institutions, and national responsibility. That combination creates tension—and tension creates curiosity.

People also respond to how he tells stories. He doesn’t posture as a superhero. He often describes learning through mistakes, working relentlessly, and relying on mentors. That tone makes his success feel explainable, not magical.

And unlike many wealthy figures who keep their lives opaque, Rubenstein has chosen visibility. He gives talks, writes, interviews, and participates in public life. When someone that powerful is also that present, people naturally want to understand what drives them.

Quick Facts

- Known for: Co-founding The Carlyle Group

- Public roles: Philanthropist, interviewer, civic figure

- Sports: Principal owner of the Baltimore Orioles

- Core themes: Leadership, institutions, history, and civic responsibility

Bottom Line

David Rubenstein is far more than a finance headline. He’s a Carlyle co-founder who helped shape modern private investing, a public interviewer who’s built a second career around leadership storytelling, and a philanthropist whose giving is tightly tied to American civic and cultural institutions. Add Orioles ownership to the mix, and you get a rare profile: a power player who seems determined to be remembered not only for wealth and deals, but for public impact and legacy.